Best Tips

How We Approach Investing For Our Clients

April 30, 2024

As financial advisors, our core mission is to create investment portfolios that maximize expected returns for each client's risk tolerance…

Lock in Bond Yields with a Ladder Strategy

March 13, 2024

As the economy stabilizes and the Federal Reserve contemplates interest rate reductions, bonds have become an increasingly attractive investment option.…

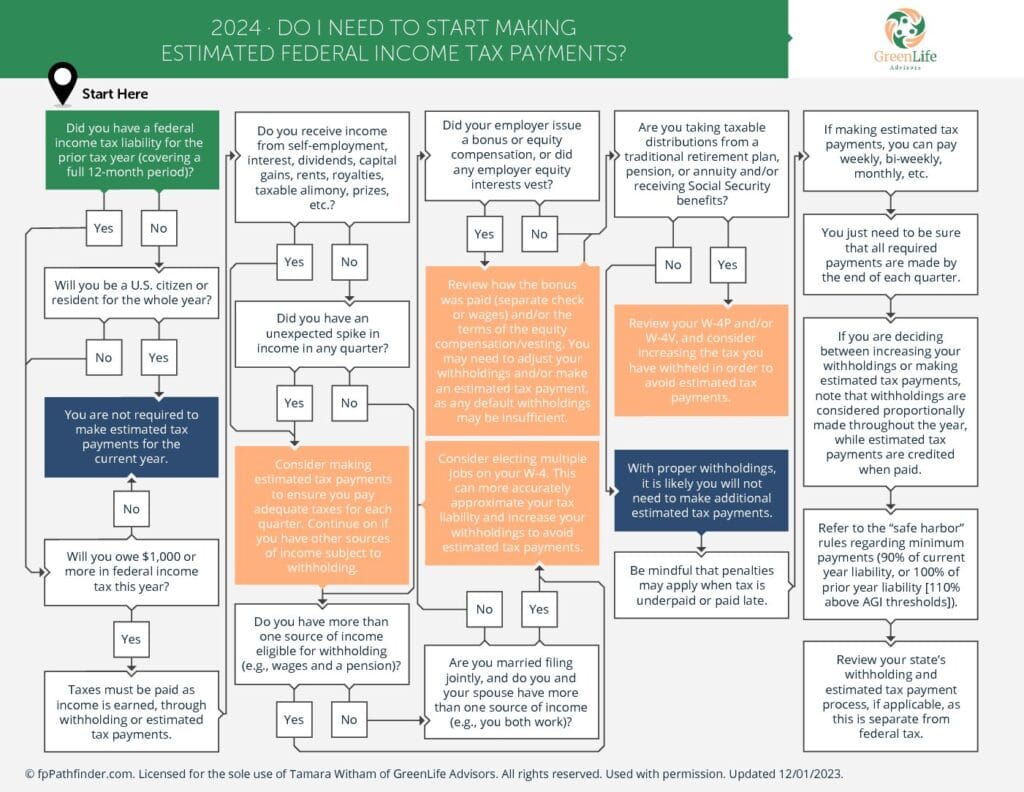

Avoid This Mistake With The IRS

March 4, 2024

Estimating your paycheck withholdings accurately is crucial. Underpaying can result in penalties and owing taxes at filing time. The law…

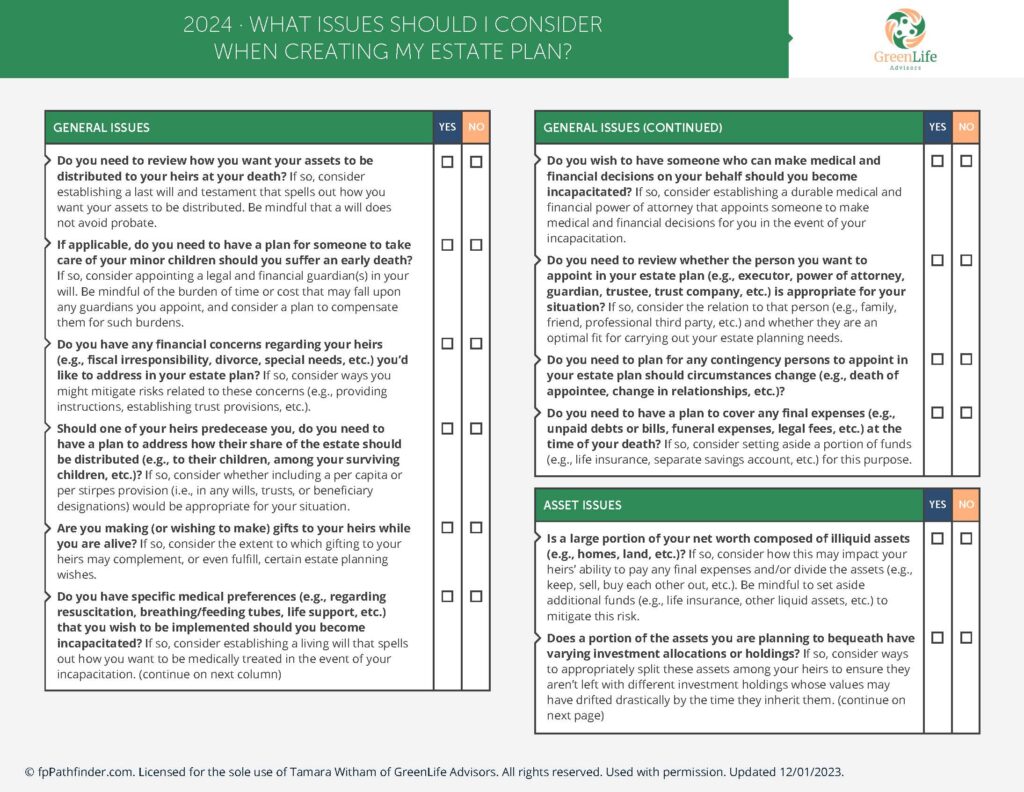

Get Organized: My Ultimate Tax Preparation Checklist

February 17, 2024

Get Organized: My Ultimate Tax Preparation Checklist It's that time of year again - tax season! As a busy person,…

Tax Planning Power

February 11, 2024

The Power of Incorporating Taxes into a Financial Plan I use tax planning software to incorporate a client's tax profile…

Dollar$ & $ense v.2

February 2, 2024

Avoid the Mistake Of Only Pre-Tax IRA

April 19, 2024

Don’t Do This In Your 20’s! Build Your Credit

April 19, 2024

Have You Saved Enough ICE?

April 19, 2024

The 50 30 20 Rule That Will Leave You Broke

April 19, 2024

Should I Put 20% Down For A New Car?

April 19, 2024

How to Choose the Right Certified Financial Planner™ for Your Needs

April 11, 2024

Find the perfect Certified Financial Planner™ in New York, Connecticut, and New Jersey with expert advice on financial planning, investment,…

Dollar$ & $ense v. 6

April 1, 2024

What I'm Working On How First-Gen Americans and Foreign-Born Individuals Benefit From Financial Planning First-generation Americans and foreign-born individuals are…

Our Expertise with First-Gen Americans and Foreign-Born Clients

March 28, 2024

What is a common financial planning challenge unique to first-generation Americans and foreign-born individuals and families that you frequently encounter…