Best Tips

What You Need to Know About Annuities

July 15, 2024

Over the past few months, GreenLife has acquired several new clients from commission brokers. As a fee-only financial planner this…

Is a Deferred Compensation Plan Right for You? Seven Key Points to Consider

July 1, 2024

Certain companies offer deferred compensation plans in which a portion of an employee's income is set aside and paid later,…

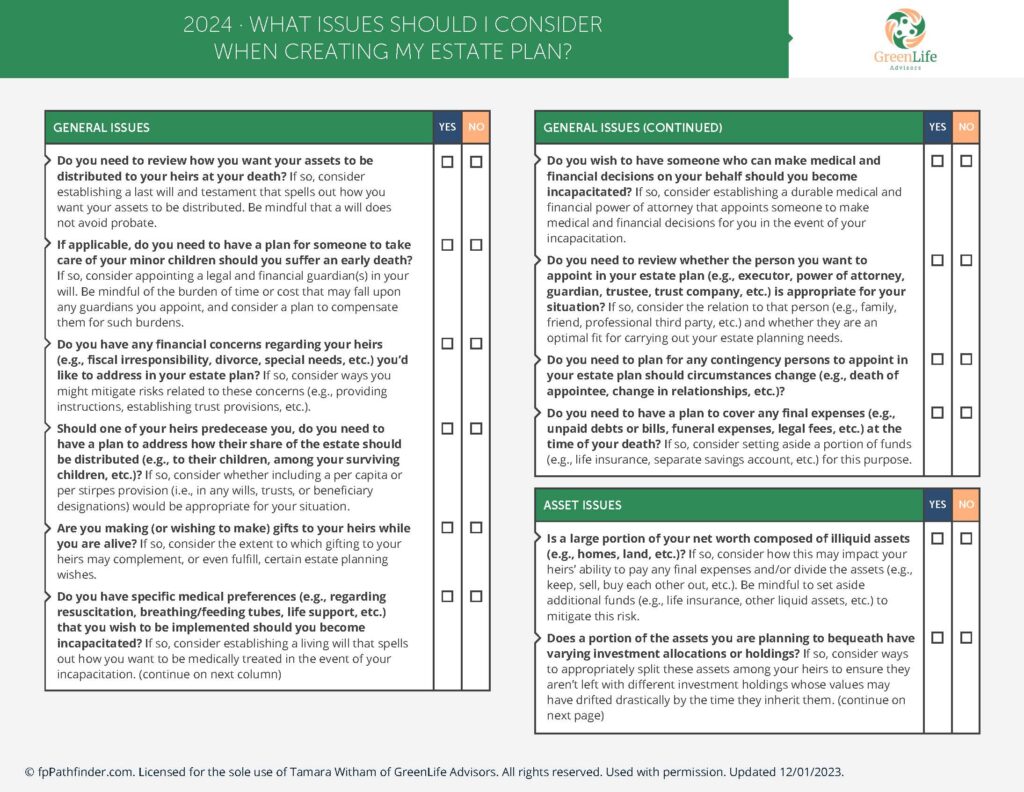

Estate Planning in the Digital Age: Preventing a Nightmare for Your Loved Ones

June 13, 2024

We have become increasingly reliant on digital technologies and the internet in our modern lives. We now have numerous digital…

Nine Proven Ways to Boost Your Credit Score

May 16, 2024

Dealing with your credit score is necessary to participate in our financial system in the U.S. It determines how much…

Dollar$ & $ense v. 8

May 1, 2024

NEWSLETTERv.8, May 1, 2024What I'm Working On How We Approach Investing for Our Clients: Core Investment PrinciplesAs financial advisors, our…

Dollar$ & $ense v.7

May 1, 2024

View in browserNEWSLETTERv.7, April 15 , 2024What I'm Working OnThe Hidden Dangers of Neglecting Your Estate PlanIn most cases, GreenLife’s…

How We Approach Investing For Our Clients

April 30, 2024

As financial advisors, our core mission is to create investment portfolios that maximize expected returns for each client's risk tolerance…

Lock in Bond Yields with a Ladder Strategy

March 13, 2024

As the economy stabilizes and the Federal Reserve contemplates interest rate reductions, bonds have become an increasingly attractive investment option.…

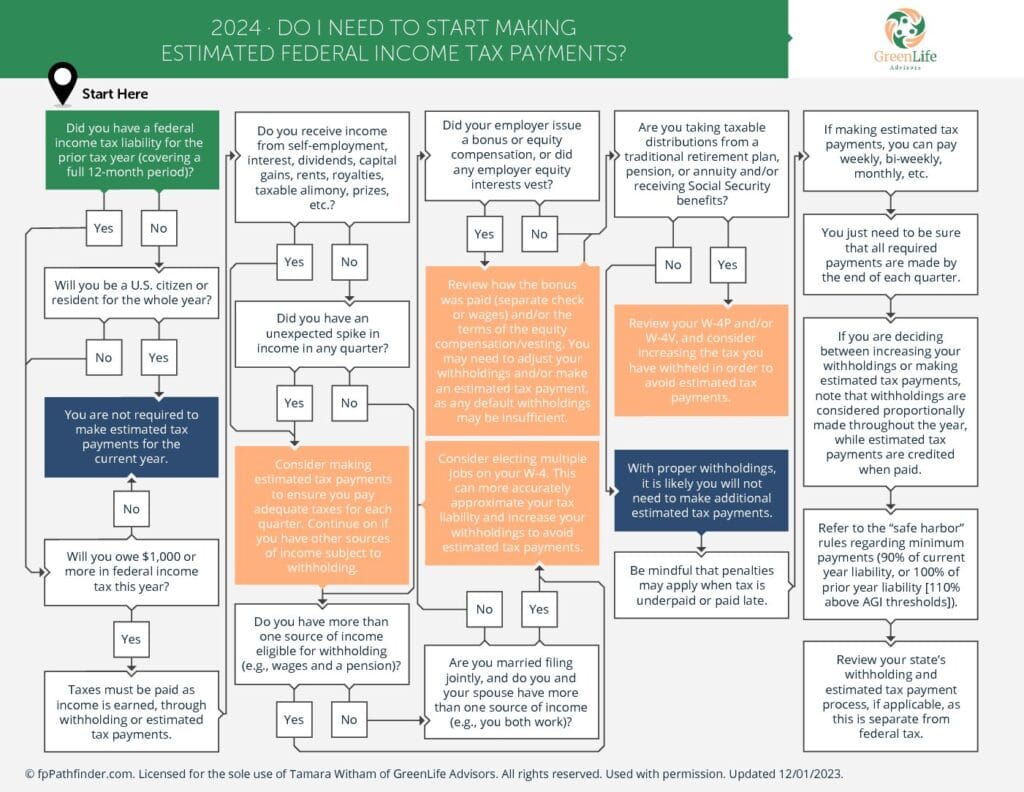

Avoid This Mistake With The IRS

March 4, 2024

Estimating your paycheck withholdings accurately is crucial. Underpaying can result in penalties and owing taxes at filing time. The law…

Get Organized: My Ultimate Tax Preparation Checklist

February 17, 2024

Get Organized: My Ultimate Tax Preparation Checklist It's that time of year again - tax season! As a busy person,…

Tax Planning Power

February 11, 2024

The Power of Incorporating Taxes into a Financial Plan I use tax planning software to incorporate a client's tax profile…

Dollar$ & $ense v.2

February 2, 2024

Financial Planning Services- Build a Financial Plan With Us

May 22, 2024

Build a Brighter Future with GreenLife Advisors' Financial Planning Services Financial planning services are essential to a safe and satisfying…

Is it worth paying for a Certified Financial Planner in New York?

May 22, 2024

The bright lights and endless possibilities of New York City come with a price tag. The cost of living is…Avoid the Mistake Of Only Pre-Tax IRA

April 19, 2024

Don’t Do This In Your 20’s! Build Your Credit

April 19, 2024

Have You Saved Enough ICE?

April 19, 2024