Building Bright Futures

Financial Planning for Your Family

Women, First Generation American & Foreign-Born Nationals, LGBTQ+.

Inclusive and welcoming environment.

As seen on "Bucket List Careers Podcast"

Financial Freedom For All

-why GreenLife-

The GreenLife Difference

Complete Fee Transparency

Conflict Free Advice

Your Interests First

Educate for Independence

Comprehensive wealth management

Investment Management

You're New to the U.S. Financial System

And Have Questions...

You and your family are overwhelmed by the complex U.S. financial system.

Q: How can I understand all the financial jargon, product offerings, retirement planning, and investment strategies in the U.S.?A: We understand the U.S. financial system can feel overwhelming with all the unfamiliar jargon and products. After helping foreign-born families like yours for over five years, we’ve learned the importance of taking a customized approach that respects your cultural background and values. We aim to cut through the confusion by explaining key terms and strategies in plain language while creating a financial plan tailored to your specific retirement dreams and goals. Whether you plan to retire here or abroad, we can help you navigate investment and tax considerations to develop a strategy for building long-term savings. If you are retiring outside of the U.S., certain tax-advantaged retirement accounts may not provide the same advantages if you were to stay in the U.S. We’re here to simplify the process and help you make informed decisions to save and prepare for the lifestyle you envision.

You are interested in home ownership and applying for credit. You are new to the U.S. credit process and credit scoring.

Q: How can I build a credit score? What are the best practices? Who are the credit rating agencies?A: Building credit can be confusing when you’re new to the U.S. system. The three major consumer credit bureaus that calculate your credit score are Equifax, Experian, and TransUnion. Checking these reports yearly helps spot errors to correct. Longer positive payment histories improve your score, enabling better rates and terms on mortgages and other loans, such as auto and other borrowings.

The best way to establish good credit is by using credit cards and paying your balances in full each month. Even if you have no credit history, you can qualify for secured cards that convert to regular cards over time. Using 10-30% of your available credit and paying on time can help raise your score. We advise families like yours which types of credit cards or secured cards match spending needs and have ideal terms for new borrowers. We explain the fine print to avoid pitfalls such as high interest rates. Additionally, we advise that keeping low credit card balances compared to their limits show responsible usage. We are our client’s advocate on the full journey to creditworthiness.

My family has substantial financial assets outside of the U.S.

Q: What do I need to know as a U.S. resident if the U.S. tax residency tests are triggered?The U.S. income tax system is often more complex than many of our clients’ native country’s tax systems, especially with respect to reporting foreign-held income. In the U.S., full income tax reporting of worldwide financial assets and income is required, meaning the IRS may tax you on your assets held abroad. Your tax residency status is not the same as your immigration status.

As a U.S. resident with overseas assets, several complex reporting requirements may apply, which can trigger U.S. tax residency status. Two of the main filing considerations are:

FBAR reporting – You must file a Report of Foreign Bank and Financial Accounts (FBAR) if you have authority over any non-U.S. bank/financial accounts with an aggregate total exceeding $10,000 at any point in the tax year. Significant penalties can apply for non-compliance.

FATCA Form 8938 – If the total value of your specified foreign financial assets is greater than applicable reporting thresholds based on tax filing status, disclosures must be made to the IRS via Form 8938 as part of your annual tax return. Thresholds start at $50,000. Failing to file can risk substantial IRS penalties.

We help avoid costly penalties by not being tax compliant.

Apart from disclosure requirements, generating income from foreign assets may lead to owing U.S. capital gains taxes and taxes paid locally, or double taxation. If they decide to hold foreign-based financial assets, we help families avoid costly mistakes, such as misreporting ownership of foreign pooled funds. These funds are classified as Passive Foreign Investment Companies (PFIC) by the IRS and are excessively taxed. Often our clients will sell foreign-based financial assets because of double taxation and the PFIC qualification.

We can help your family document overseas assets while ensuring U.S. tax rules are followed. Relying on our expertise can give you confidence to avoid headaches with the IRS down the road.

U.S. insurance coverages are drastically different than insurance in your native country.

Q: Does my family need to purchase life insurance, disability insurance, and/or private health insurance coverage?A: Insurance needs can vary greatly between the U.S. and other countries. We have a deep understanding of these differences based on working with families like yours over the years.

Regarding life insurance, having adequate coverage is crucial to protect loved ones financially. Many employers provide basic life insurance between one to two times base salary, but in our experience this base benefit may not be enough to adequately protect a family in the event of a premature death. Additionally, employer policies may not be portable if an employee leaves. Many families utilize private insurers to guarantee more complete, customizable protection. We explain options to find the right amount and type of policy based on your situation.

Navigating U.S. health insurance also poses challenges. We help compare company, private, or public exchange plans so families obtain full coverage. We also explore such available options of associated Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA).

Disability insurance can replace income lost to injury/illness. However, supplemental policies are expensive, pricing some families out. Also, many insurers deny claims for those residing abroad, even with premiums paid, which may be important for someone looking to return to his or her native country in the event of a disability.

Every family has unique priorities and risk tolerance. Through discussion, we craft tailored recommendations on available coverage to suit both your finances and safety needs. Our aim is to educate you about offerings, so you will make informed choices to safeguard your family’s financial security.

Your Free Financial Assessment

A step-by-step process to help you evaluate our services and make an informed decision

Step #1 – Schedule a 15-Minute Meeting by Zoom

A 15 minute Zoom meeting will allow us both to make sure your situation matches our expertise.

Step #2 – Meet With Us for 60 Minutes In Person or Virtually

A 60-minute meeting will allow us to dive into your goals, needs, and concerns.

Step #3 – Get Your Free Financial Assessment

Learn concrete solutions how we can help you lower taxes and streamline your investments for success.

⇒ Tax Return Analysis

⇒ Investment Analysis

⇒ Customized Solutions to Your Needs

Blog

What You Need to Know About Annuities

Over the past few months, GreenLife has acquired several new clients from commission brokers. As a fee-only financial planner this…

Is a Deferred Compensation Plan Right for You? Seven Key Points to Consider

Certain companies offer deferred compensation plans in which a portion of an employee's income is set aside and paid later,…

Estate Planning in the Digital Age: Preventing a Nightmare for Your Loved Ones

We have become increasingly reliant on digital technologies and the internet in our modern lives. We now have numerous digital…

Nine Proven Ways to Boost Your Credit Score

Dealing with your credit score is necessary to participate in our financial system in the U.S. It determines how much…

Dollar$ & $ense v. 8

NEWSLETTERv.8, May 1, 2024What I'm Working On How We Approach Investing for Our Clients: Core Investment PrinciplesAs financial advisors, our…

Dollar$ & $ense v.7

View in browserNEWSLETTERv.7, April 15 , 2024What I'm Working OnThe Hidden Dangers of Neglecting Your Estate PlanIn most cases, GreenLife’s…

How We Approach Investing For Our Clients

As financial advisors, our core mission is to create investment portfolios that maximize expected returns for each client's risk tolerance…

Lock in Bond Yields with a Ladder Strategy

As the economy stabilizes and the Federal Reserve contemplates interest rate reductions, bonds have become an increasingly attractive investment option.…

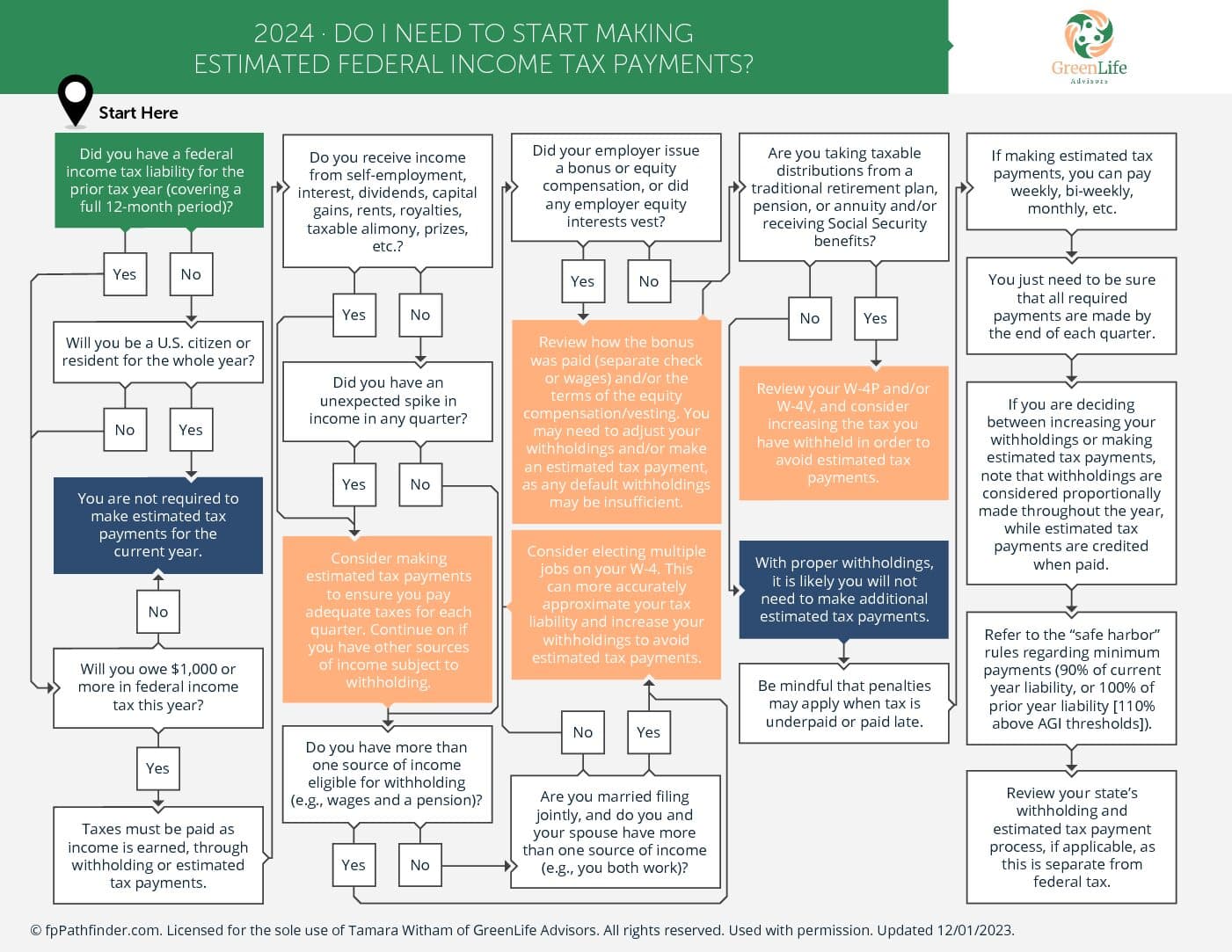

Avoid This Mistake With The IRS

Estimating your paycheck withholdings accurately is crucial. Underpaying can result in penalties and owing taxes at filing time. The law…

Get Organized: My Ultimate Tax Preparation Checklist

Get Organized: My Ultimate Tax Preparation Checklist It's that time of year again - tax season! As a busy person,…

Tax Planning Power

The Power of Incorporating Taxes into a Financial Plan I use tax planning software to incorporate a client's tax profile…

Financial Planning Services- Build a Financial Plan With Us

Build a Brighter Future with GreenLife Advisors' Financial Planning Services Financial planning services are essential to a safe and satisfying…

Is it worth paying for a Certified Financial Planner in New York?

The bright lights and endless possibilities of New York City come with a price tag. The cost of living is…

About Greenlife Advisors

GreenLife Advisors was created to help you reach your financial goals through a pragmatic planning and investing process. We are passionate about working with families and helping make a difference in their lives.

We are a member of NAPFA and of XY Planning Network, organizations dedicated to fee-only financial planning professionals. We choose to practice as fee-only advisors as we believe that best enables us to act as a true fiduciary for you rather than encounter the conflicts of interest inherent in commission-based compensation, as is the case with many other financial advisors focused on selling products. As GreenLife Advisors is a fee-only financial planning and investment advisory firm, we will not sell any commissioned product.