What is a common financial planning challenge unique to first-generation Americans and foreign-born individuals and families that you frequently encounter when working with your clients? How do you work with them to overcome this challenge?

First-generation Americans and foreign-born individuals are often overwhelmed by the complexities of the U.S. financial system. After helping foreign-born families for many years, we’ve learned the importance of a customized approach that respects our clients’ cultural backgrounds and values. We aim to address the confusion by explaining key terms and strategies in plain language while creating a financial plan tailored to their retirement dreams and goals. Whether they plan to retire here or abroad, we can help them navigate investment and tax considerations to develop a strategy for building long-term savings. Suppose a client plans to retire outside of the U.S. Certain tax-advantaged retirement accounts may not provide the same advantages as if they stayed stateside. We’re here to simplify the process and help clients make informed decisions to save and prepare for the lifestyle they envision.

A concrete example is understanding and simplifying the decision to purchase insurance. Insurance needs can vary significantly between the U.S. and other countries. Adequate coverage is crucial to protecting loved ones financially. Many employers provide basic life insurance between one- and two-times base salary. In our experience, this base benefit may not be enough to adequately protect a family in the event of a premature death. Additionally, employer policies may not be portable if an employee leaves. Many families utilize private insurers to guarantee complete customizable protection. We explain options to find the right amount and type of policy based on each situation.

Navigating U.S. health insurance also poses challenges. We help compare company, private, and public exchange plans so families can obtain optimal coverage. We also explore the options of associated Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA).

Disability insurance can replace income lost to injury/illness. However, supplemental policies are expensive, pricing out some families. Also, many insurers deny claims for those residing abroad, even with premiums paid, which may be necessary for someone looking to return to his or her native country in the event of a disability.

Every family has unique priorities and risk tolerance. Through discussion, we craft tailored recommendations on available coverage to suit our clients’ finances and safety needs. We aim to educate clients about offerings so they will make informed choices to safeguard their families’ financial security.

How do the services you offer first-generation Americans and foreign-born individuals and families distinguish your firm from other advisory firms?

According to research by Herbers and Company, nine in ten investors want their advisors to help with tax planning, and three-quarters want help with retirement planning services. However, few advisory firms offer both services, and even fewer do it well. GreenLife has focused on concrete solutions for our clients’ tax planning and retirement needs.

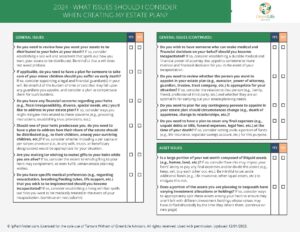

The U.S. income tax system is often more complex than many of our clients’ respective native country’s tax systems, especially concerning reporting foreign-held income. In the U.S., full income tax reporting of worldwide financial assets and income is required, meaning the IRS may tax assets held abroad. Tax residency status is not the same as immigration status. As a U.S. resident with overseas assets, several complex reporting requirements may apply, which can trigger U.S. tax residency status.

We use tax planning software to incorporate a client’s tax profile into our financial planning services. We’re excited to offer tax planning as part of our firm’s comprehensive financial planning because taxes impact virtually every aspect of one’s finances.A client’s tax return is a financial fingerprint: it’s unique for that person, complete with valuable clues and information, all buried in dozens of pages and hundreds of numbers. Understanding the return equips us to have more valuable and actionable conversations with our clients. Additionally, we demystify the world of income taxes and help clients understand this vital piece of their unique financial picture.

Tax planning includes reviewing a tax return in depth to identify potential opportunities, both now and in the future, to minimize lifetime tax liabilities. Tax planning differs from tax preparation, which may focus on compliance with current tax laws and rules.By analyzing a client’s current and prior tax returns, we can recommend steps to potentially lower the next year’s tax bill and uncover other long-term planning opportunities.

Here are some of the ways we may be able to leverage a client’s return during financial planning and investing strategies:

· Tax-Efficient Portfolio Management: Being fluent in a client’s tax status informs better investment strategies, such as realizing capital gains rather than ordinary income for greater tax efficiency.

· Retirement Optimization: Knowing a client’s tax details helps us determine the role of each retirement account in his or her overall financial planning strategy. Conversations often focus on Roth IRA conversions.

· Tax-Sensitive Withdrawal Strategies: Taxes are one factor when withdrawing retirement funds. We can illustrate how proper tax management is critical for withdrawal decisions.

· Coordination with a Client’s CPA: Understanding a client’s tax profile allows us to collaborate effectively on an integrated financial strategy with tax professionals.

· Ongoing Tax Management: Tax laws change frequently. We can suggest adjustments to address new laws and regulations by reviewing returns. We can run projections to see how potential changes (e.g., filing status, dependents, the sale of a business, stock option exercises, etc.) may impact a client’s upcoming tax liability and model how potential changes may impact upcoming tax liabilities.

For first-generation Americans and foreign-born individuals who are unsure whether or not they should hire a financial advisor at the current point in their lives, what guidance can you provide to help them make a more informed and educated decision?

For first-generation Americans and foreign-born individuals who are navigating the complex financial landscape of a new country, hiring a knowledgeable financial advisor sooner rather than later can provide significant advantages. An advisor well-versed in cultural differences can offer tailored guidance aligned with each client’s values and goals, helping build a solid financial foundation through comprehensive planning for investment strategies, retirement, and risk mitigation.

Acting now is better than delaying until later if an individual has specific financial planning needs. The earlier he or she implements a plan, the more investments can potentially grow through compounding interest over time. An advisor also can identify and address risks like insufficient insurance coverage and excessive debt before these issues escalate. Setting clear financial goals from the start, whether for retirement, education funding, or a home purchase, increases one’s chances of success with a defined roadmap.

Working with an advisor can save thousands of dollars through optimized tax planning strategies and ensure a client claims eligible deductions and credits. As careers and family dynamics evolve, an advisor can help adapt a client’s plan to manage transitions like job changes, marriage, and having children – a proactive approach that protects long-term financial security.

Not all people need an ongoing relationship with a certified financial planner. Some may already have a good grasp on managing finances and making decisions. While ongoing advisory services may not be necessary, everyone can benefit from at least an initial consultation. Most advisors, including our firm, offer complimentary meetings to assess if there is a good fit and explore how the advisor can provide value based on the individual’s circumstances. There is little downside to contacting an advisor for this initial consultation.

Ultimately, procrastinating on financial planning can harm those who need it. Starting sooner allows one to capitalize on wealth-building opportunities while avoiding costly mistakes. The earlier one works with an advisor, the better positioned they will be to achieve their financial objectives.