What I’m Working On

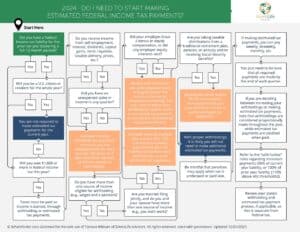

Estimating Tax Withholdings Is Crucial

Underpaying can result in penalties and owing taxes at filing time. The law in the United States

requires most employees and self-employed business owners to pay at least 90% of their taxes before

April or earlier. This topic became impactful in 2024 when the IRS raised the penalty interest rate

from 3% to 8%[1]. The IRS determines the tax underpayment penalty by calculating the amount based

on the total underpayment amount, the period when the underpayment occurred, and the interest rate

for the underpayments, starting on the due date taxes were owed. The interest rate is reset each

quarter. State and local governments apply their own penalty calculations as well.

Overpaying gives the IRS and your state and local government an interest-free loan throughout the

year. In fact, the IRS states that it has 45 days after it receives your tax return physically or

electronically before it starts owing you interest on your overpayment amount. The ideal scenario

is to withhold as close to your actual tax liability as possible.

[1] https://www.wsj.com/podcasts/your-money-matters/irs-more-tha….

Estimating Federal Income Tax Payments

Market Indices

Year-to-date, as of February 29, 2024

Stocks:

Large Cap S&P 500, +7.34%

Small Cap Russell 2000, +2.21%

Technology NASDAQ, +7.93% International MSCI EAFE, +2.88% Bonds:

U.S. Aggregate AGG, -1.37%

Sources: FactSet; Dow Jones Market Data; S&P Dow Jones Indices; ICE Data Services; Bloomberg

Indices; and

J.P. Morgan.

What I’ve Enjoyed

With my son Cole by my side, we embarked on a whirlwind college tour across the South, cramming

five schools into just four sun- drenched days. Immersed in Southern hospitality, we devoured

iconic dishes like crispy fried chicken and savory shrimp and grits. Cole gained valuable insights

into his ideal college environment, while I left yearning to matriculate and relive the college

experience

once again!